Froma Harrop's piece, which appeared last week, is particularly nasty. Appearing under a headline entitled "Bernie Sanders and Racism Lite,' Harrop insinuated that Bernie's campaign is associated with racism. She even accused "Sanders' white posses" of "invading campaign events of other presidential contenders, including Donald Trump rallies. But Harrop cited no evidence to support such a charge.

The liberal media can't have it both ways. Most liberal commentators argue that Trump's rallies are disrupted because Trump incites violence by his message and tone. But now Harrop suggests that it is those nasty Bernie supporters who are causing all the ruckus.

She also cynically interpreted Bernie's observation that his rallies were largely peaceful even when held in "high crime areas." According to Harrop, "high crime areas" is a veiled reference to African American neighborhoods.

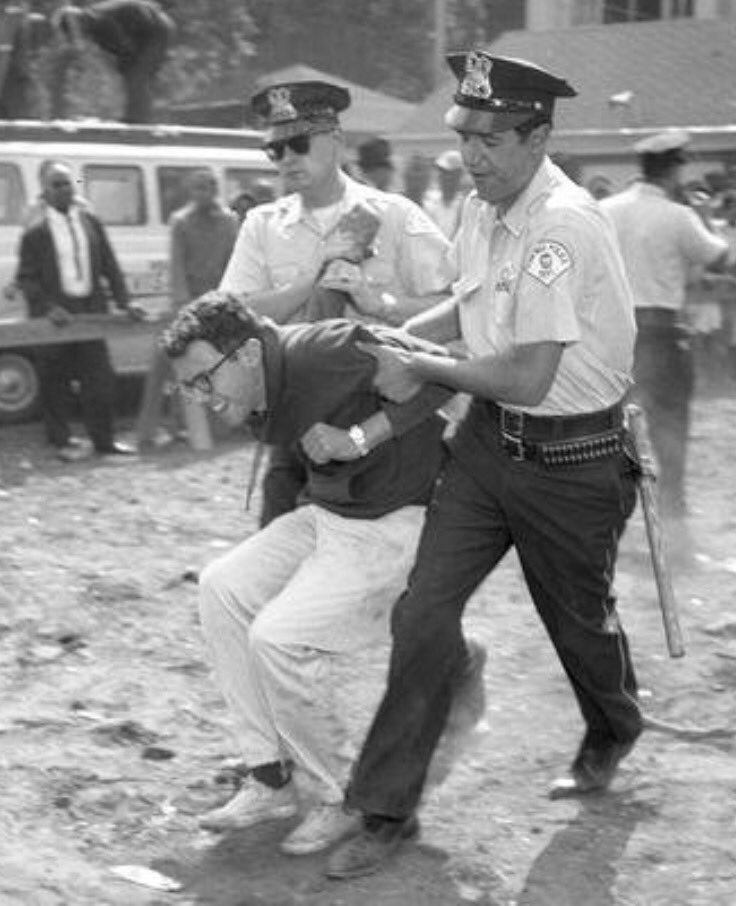

Harrop admits--as she must--that Bernie has a "staunch civil rights record." Indeed, Bernie was arrested in 1963 for participating in a civil rights protest against segregated schools in Chicago; and he was active in the Congress On Race Equality (CORE) during the 1960s. Does Hillary have a comparable civil rights record? No, she does not.

Perhaps the most ridiculous part of Harrop's hatchet job on Bernie was her insinuation that he moved to Vermont, which she described as "the whitest state in the nation," for racist reasons. Vermont, Harrop confides, "had become a safe haven for liberals leaving--the word then was 'fleeing'--the cities."

What a pile of horse manure! A great many states have low minority populations--Montana, Wyoming, North Dakota, Vermont, Maine. Is Harrop suggesting that people who move to those states are a bunch of racists? If that's true, then pack me to a re-education camp because I lived in Alaska for nine years during the 1980s.

In my view, Harrop is one of a band of panting puppies eager to assist Hillary Clinton clinch the Democratic presidential nomination by denigrating Bernie Sanders--the only genuinely decent candidate left in the race. Cokie and Steve Roberts performed a similar service for Hillary in an op ed essay as did Frank Bruni of the New York Times, who suggested that Bernie was a sore loser because he didn't drop out of the race for president.

But it is the liberal media elites who are the sore losers. And what they have lost is the public's respect for their journalistic integrity. And that's why millions of Americans have decided to think for themselves during this election cycle instead of allowing CNN, the New York Times, and journalistic lap dogs like Froma Harrop to do their thinking for them.

I hate to break the news to you, Froma, but a lot of Americans find Hillary totally unacceptable as a president; and insinuating that Bernie is a racist is not the way to persuade Americans to change their minds.

|

| Who is that guy? |

Frank Bruni. The Cult of Sore Losers. New York Times, April 26, 2016. Accessible at http://www.nytimes.com/2016/04/27/opinion/the-cult-of-sore-losers.html?_r=0

Froma Harrop. Bernie Sanders and Racism Lite. Seattle Times, May 19, 2016. Accessible at http://www.seattletimes.com/author/froma-harrop/

Tim Murphy. Here's What Bernie Sanders Actually Did In the Civil Rights Movement. Mother Jones, February 11, 2016. Accessible at http://www.motherjones.com/mojo/2016/02/bernie-sanders-core-university-chicago