The Democrats are in a funk. Donald Trump beat Kamala Harris handily last November despite being outspent 2 to 1. Then Trump affirmed all his cabinet nominations, even RFK Jr., which was a miracle. And finally, the President got the Big, Beautiful Bill through Congress by his arbitrary deadline--July 4th.

Democrats have responded to their reversal of fortune by returning to their three standard tactics: First, they've filed hundreds of lawsuits against the Trump administration before friendly judges. Second, some elected Democratic politicians have contrived to get restrained or arrested for impeding Trump's deportation actions--great photo ops!

Finally, several Democratic politicians have unleashed a torrent of profanity. In fact, Congresswoman Jasmine Crockett's status as the queen of gutter language is being challenged by several of her colleagues.

None of these tactics has increased the standing of the Democratic Party with American voters. Why not do something constructive?

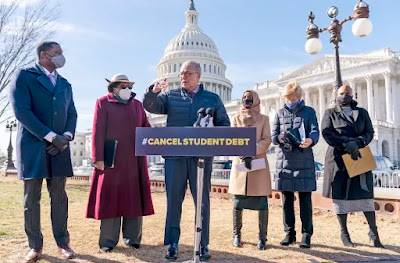

I propose that Democrats engage with Republicans in a bipartisan effort to give bankruptcy relief to overburdened student-loan debtors. Our elected politicians need to acknowledge that the federal student loan program is an epic disaster that can't be fixed by income-based repayment plans or economic hardship deferrals.

Distressed student borrowers need to be able to discharge their loans in bankruptcy like any other consumer debt. Currently, they are barred from relief by the "undue hardship" language in the Bankruptcy Code.

Not right away, of course. No one should obtain a lucrative undergraduate or professional degree and file for bankruptcy the next day.

No, every student-loan debtor should strive to pay off their college loans within ten years. Borrowers who are insolvent at the end of that period should be able to shed their debt in a federal bankruptcy court. And the same relief should be available to parents who took out Parent PLUS loans.

In other words, no more economic hardship deferments or income-based repayment plans. Instead, all student borrowers will be expected to pay off their college debt by the end of a decade. Those who fail to do so can walk over to the bankruptcy court and get relief.

Why hasn't Congress enacted this simple reform to the Bankruptcy Code? The explanation is simple.

Our elected politicians see the higher education industry as their most important constituency--not the millions of college students forced to take out burdensome loans to pay their outrageous tuition bills.

The colleges are okay with the status quo. They get juiced with federal student loan money year after year, regardless of whether their graduates can pay off the debt.

If beaten-down student borrowers had access to the bankruptcy courts, millions would file for relief. Then, Americans would see just how much a college education is overpriced and how worthless those cheesy liberal arts and humanities degrees really are.

And, if the Democrats took the lead in getting bankruptcy relief for college borrowers, they would be heroes, instead of a bunch of bums, which is how they're perceived now.