I'm sorry, so sorry

That I was such a fool

I'm Sorry (1960)

Sung by Brenda Lee

Lyrics by Dub Allbritten & Ronnie Self

Most country and western songs are about regret: I'm sorry I cheated on my wife; I regret mouthing off to a biker in the honky-tonk, I wish I hadn't shot a man in Reno.

I don't know of any C & W song about student loans, but there should be. A recent survey reported that about 50 percent of student-loan debtors regretted how much they borrowed to go to college. More than a third said they would not have gone to college had they realized what it would cost them.

But the people who are really, really sorry are the parents who took out loans to pay for their children's college education. If they co-sign a private loan for a child, they are on the hook for it even if their child dies. And parents will find it is virtually impossible to discharge a co-signed student loan in bankruptcy, whether it is a private loan or a a federally subsidized loan.

In fact, I say this unequivocally: Parents should never borrow money to pay for their child's college education.

Yet our federal government peddles Parent Plus loans--student loans taken out by parents--as a good way to help finance a child's college costs. DOE recently posted a blog telling parents that "PLUS loans are an excellent option if you need money to pay your child's educational expenses," although it cautions that parents need to make sure they understand the loan terms before they take out a PLUS loan.

And what are those terms? DOE's blog posting says that the current interest rate is 6.31 percent and that monthly repayment begins immediately. Monthly PLUS loan payments are not postponed while the child is still in college.

DOE then summarizes various PLUS loan repayment plans, including an income-contingent plan (ICR) that allows parents to pay 20 percent of their discretionary income for 25 years.

Of course it is madness for parents to pay a fifth of their discretionary income for 25 years in order for their child to go to college. There are lots of college options that don't require that kind of sacrifice.

DOE assures parents that any unpaid balance on their PLUS loan will be forgiven after 25 years. But note that DOE doesn't tell parents that they could have a big tax bill for the amount of the loan that is forgiven.

And DOE didn't warn parents that they will find it almost impossible to discharge a PLUS loan in bankruptcy should they run into financial trouble due illness, job loss, or some other financial calamity.

DOE ends its deceptive blog on this cheery note. "Yes, there's lots to consider when it comes to taking out a Direct PLUS loan, but there are many benefits to getting one if you need help paying your child's education."

In fact, there's nothing to consider. If your children can't finance their college education without you going into debt, then they need to develop another plan.

My guess is that a lot of parents take out PLUS loans to help their kids go to some fancy East Coast private school, which is foolish. If your children cannot afford to go to Harvard or Dartmouth or Amherst without putting you into debt, then they need to enroll at a nearby public university and take a part-time job at McDonald's.

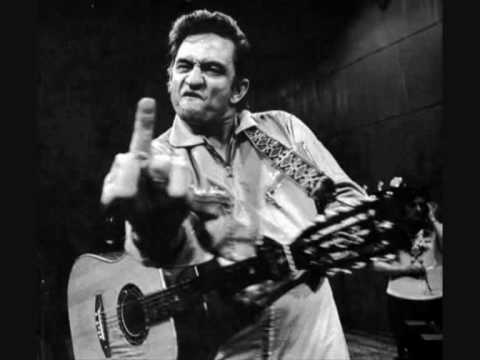

Trust me. You and your children will be better off if you avoid all college options that force Mom and Pop to go into debt. Johnny Cash was sorry he shot that guy in Reno, but he was not any sorrier than you will be if you take out a loan to send your child to college.

References

Jessica Dickler. Buyer's College buyer's remorse is real. CNBC News, April 7, 2016. Accessible at http://www.cnbc.com/2016/04/07/college-buyers-remorse-is-real.html

Jessica Dickler. College costs are out of control. CNBc News, July 16, 2016. Accessible at http://www.cnbc.com/2016/07/12/college-costs-are-out-of-control.html

Citizens Bank. Millennial College Graduates with Student Loans Now Spending Nearly One-Fifth of Their Annual Salaries on Student Loan Repayments. April 7, 2016. Accessible at http://investor.citizensbank.com/about-us/newsroom/latest-news/2016/2016-04-07-140336028.aspx

Lisa Rhodes. PLUS Loan Basics for Parents. Homeroom, August 8, 2016. Posted on the Official Blog Of the U.S. Department of Education. Available at http://blog.ed.gov/

But the people who are really, really sorry are the parents who took out loans to pay for their children's college education. If they co-sign a private loan for a child, they are on the hook for it even if their child dies. And parents will find it is virtually impossible to discharge a co-signed student loan in bankruptcy, whether it is a private loan or a a federally subsidized loan.

In fact, I say this unequivocally: Parents should never borrow money to pay for their child's college education.

Yet our federal government peddles Parent Plus loans--student loans taken out by parents--as a good way to help finance a child's college costs. DOE recently posted a blog telling parents that "PLUS loans are an excellent option if you need money to pay your child's educational expenses," although it cautions that parents need to make sure they understand the loan terms before they take out a PLUS loan.

And what are those terms? DOE's blog posting says that the current interest rate is 6.31 percent and that monthly repayment begins immediately. Monthly PLUS loan payments are not postponed while the child is still in college.

DOE then summarizes various PLUS loan repayment plans, including an income-contingent plan (ICR) that allows parents to pay 20 percent of their discretionary income for 25 years.

Of course it is madness for parents to pay a fifth of their discretionary income for 25 years in order for their child to go to college. There are lots of college options that don't require that kind of sacrifice.

DOE assures parents that any unpaid balance on their PLUS loan will be forgiven after 25 years. But note that DOE doesn't tell parents that they could have a big tax bill for the amount of the loan that is forgiven.

And DOE didn't warn parents that they will find it almost impossible to discharge a PLUS loan in bankruptcy should they run into financial trouble due illness, job loss, or some other financial calamity.

DOE ends its deceptive blog on this cheery note. "Yes, there's lots to consider when it comes to taking out a Direct PLUS loan, but there are many benefits to getting one if you need help paying your child's education."

In fact, there's nothing to consider. If your children can't finance their college education without you going into debt, then they need to develop another plan.

My guess is that a lot of parents take out PLUS loans to help their kids go to some fancy East Coast private school, which is foolish. If your children cannot afford to go to Harvard or Dartmouth or Amherst without putting you into debt, then they need to enroll at a nearby public university and take a part-time job at McDonald's.

Trust me. You and your children will be better off if you avoid all college options that force Mom and Pop to go into debt. Johnny Cash was sorry he shot that guy in Reno, but he was not any sorrier than you will be if you take out a loan to send your child to college.

|

| Johnny Cash: He shot a man in Reno, but he's really, really sorry. |

Jessica Dickler. Buyer's College buyer's remorse is real. CNBC News, April 7, 2016. Accessible at http://www.cnbc.com/2016/04/07/college-buyers-remorse-is-real.html

Jessica Dickler. College costs are out of control. CNBc News, July 16, 2016. Accessible at http://www.cnbc.com/2016/07/12/college-costs-are-out-of-control.html

Citizens Bank. Millennial College Graduates with Student Loans Now Spending Nearly One-Fifth of Their Annual Salaries on Student Loan Repayments. April 7, 2016. Accessible at http://investor.citizensbank.com/about-us/newsroom/latest-news/2016/2016-04-07-140336028.aspx

Lisa Rhodes. PLUS Loan Basics for Parents. Homeroom, August 8, 2016. Posted on the Official Blog Of the U.S. Department of Education. Available at http://blog.ed.gov/

Good day,

ReplyDeleteAre you in need of an urgent business loan to startup or expand your business?

We offer all kind of Business Loan and Personal Loan. We gives out loan in a very low interest rate of 3%.

Kind regards,

Vicent Lance Jessy

23 E. Concord Street, Orlando, FL 32801

Tel: +1{618 223 6800}

Email: {vincentlancejessy@gmail.com}

The ideas will either help students to bring around the sufficient details and hopefully guides them to the success.

ReplyDeleteNobody can reject the info you have given in the blogs, this is actually a great work.

ReplyDeleteGoogle Web Site